How the Bank of Canada’s Interest Rate Decisions Affect Your Everyday Life

How the Bank of Canada’s Interest Rate Decisions Affect Your Everyday Life

When the Bank of Canada makes headlines for raising or lowering its key interest rate, it might seem like distant financial news. But these decisions have a direct impact on your wallet—especially if you live in Moncton, New Brunswick, or anywhere on the East Coast. Let’s break down why these rate changes matter, and how they shape your everyday financial choices.

What Is the Bank of Canada’s Interest Rate?

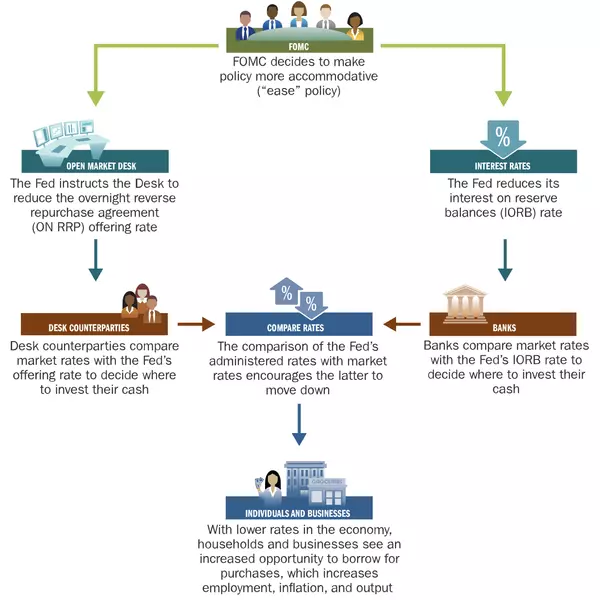

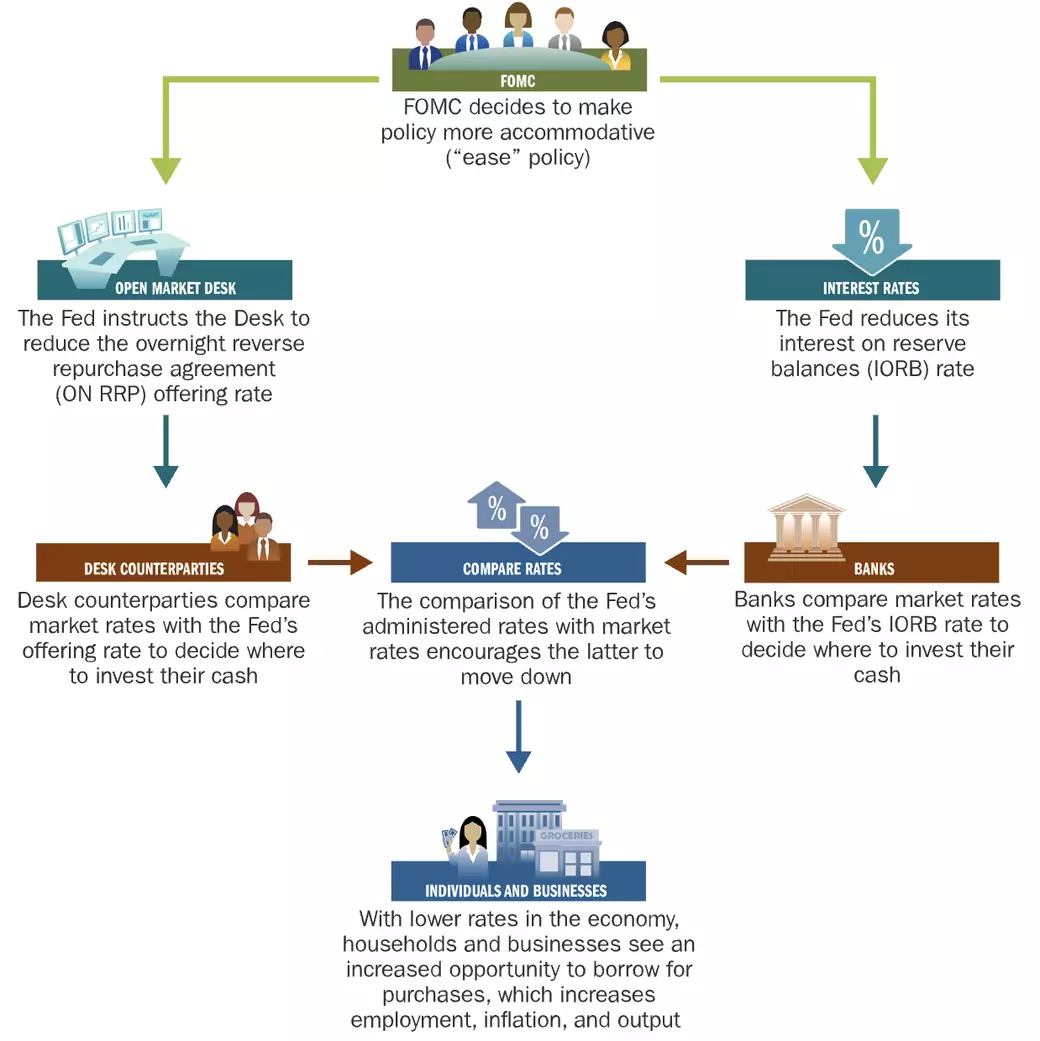

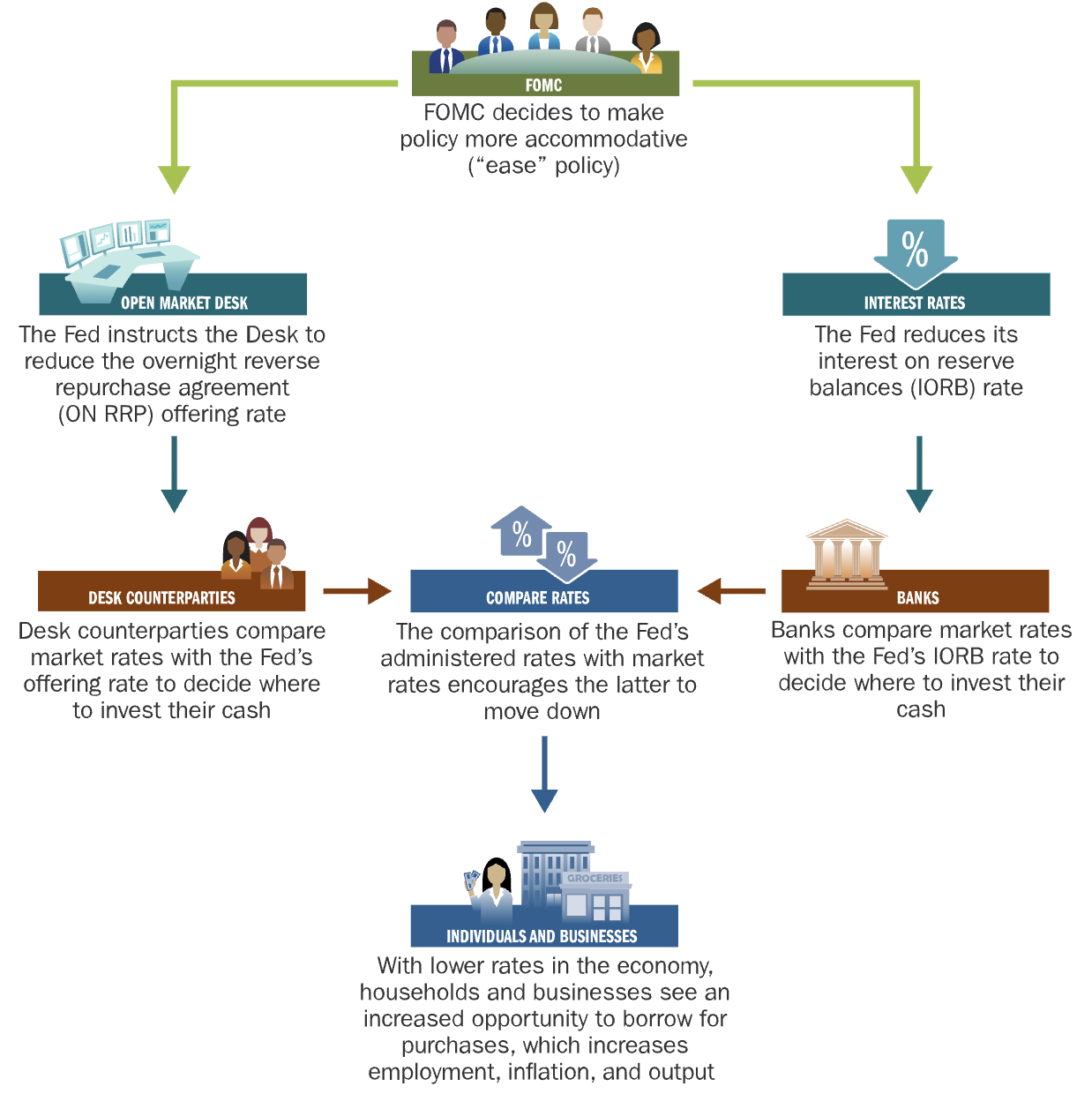

Think of the Bank of Canada’s interest rate as the heartbeat of our economy. It’s the rate at which banks borrow money from one another, and it sets the tone for all other interest rates—from mortgages to savings accounts. When the Bank raises or lowers this rate, it’s sending a signal that affects the cost of borrowing and the rewards of saving for everyone.

How Rate Changes Affect Your Borrowing

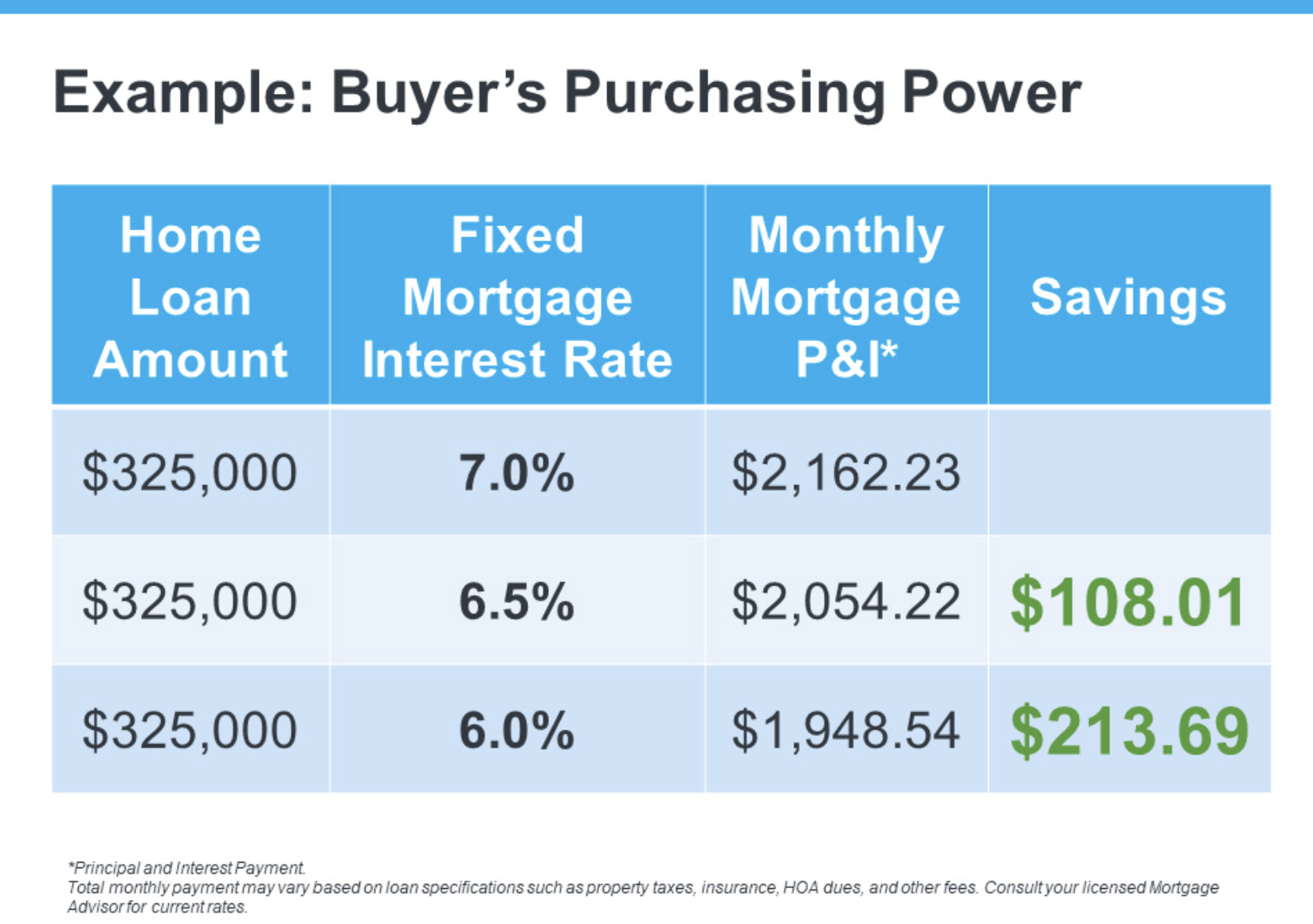

Let’s say you’re considering buying a home in Moncton. If the Bank of Canada hikes its rate, mortgage lenders often follow suit, meaning higher monthly payments for new buyers or anyone with a variable-rate mortgage. The same goes for car loans and lines of credit—borrowing money becomes more expensive. Conversely, when rates drop, you might find it’s a great time to lock in a lower mortgage or refinance existing debt.

Savings and Investments: The Other Side of the Coin

It’s not all bad news when rates rise! Higher rates can mean better returns on savings accounts and GICs, which is good for those planning for the future. For investors in New Brunswick, interest rate changes can also influence the stock market, affecting everything from RRSPs to RESP accounts.

Real-Life Example: A Moncton Family’s Story

Imagine the Martins, a family in Moncton. When rates were low, they bought their first home with a manageable mortgage. But when the Bank of Canada raised rates, their variable payments crept up. They had to adjust their budget, cutting back on extras to keep up. On the flip side, their savings account started earning more interest, helping them set aside money for their kids’ education.

Tips for Navigating Rate Changes

- Stay Informed: Follow local news and updates from the Bank of Canada.

- Review Your Debt: Consider locking in fixed rates if you’re worried about increases.

- Boost Your Savings: Take advantage of higher rates to grow your emergency fund.

- Talk to Local Experts: A Moncton-based mortgage broker or financial advisor can help you make sense of the changes.

Whether you’re buying a home, saving for the future, or just trying to make ends meet, the Bank of Canada’s decisions reach right into your daily life. By staying informed and proactive, you can turn these changes into opportunities—right here in Moncton and across the East Coast.

Recent Posts