Moncton Buyer’s Guide

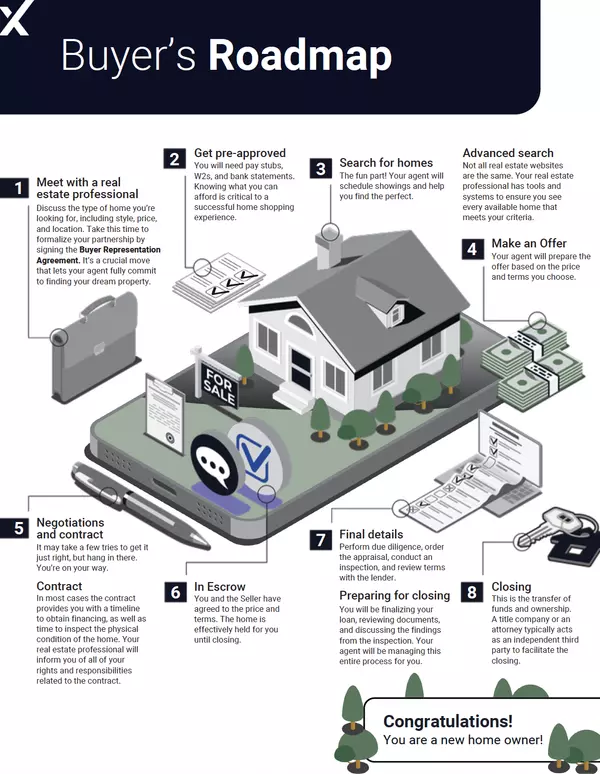

A step-by-step guide to buying a home in Moncton, Dieppe, and Riverview. Learn how to prepare financially, navigate inspections and offers, and buy with confidence in New Brunswick’s real estate market.

Delivered instantly to your inbox. No spam, ever.

GET YOUR COMPLETE HOME BUYING GUIDE -------->>

FREQUENTLY ASKED QUESTIONS (FAQ'S)

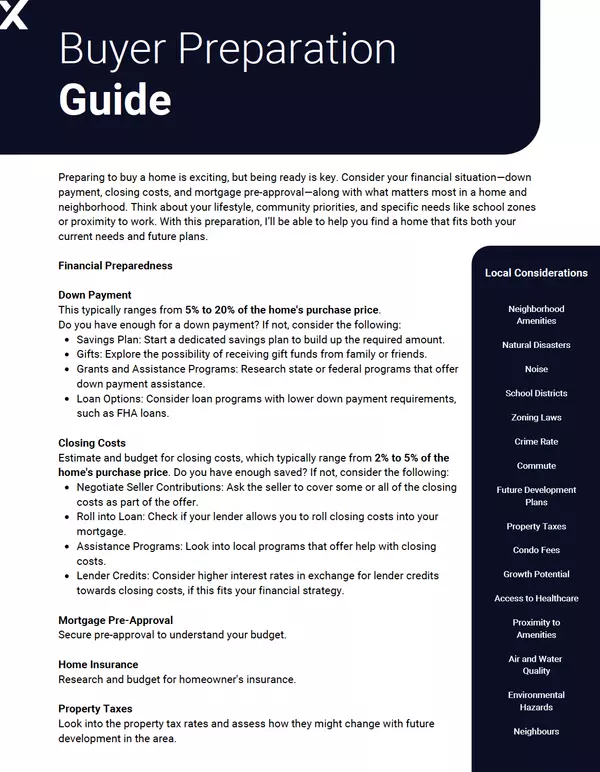

How much do I need for a down payment in New Brunswick?

In Canada, the minimum down payment depends on the purchase price. Homes under $500,000 require as little as 5% down. For homes between $500,000 and $999,999, a blended minimum applies. A 20% down payment is required to avoid mortgage default insurance. I can help you understand what makes the most sense based on your situation.

What is the difference between a mortgage pre-qualification and pre-approval?

What are closing costs, and how much should I budget?

How does my credit score affect my mortgage rate?

What's included in my monthly mortgage payment?

How long does the home buying process usually take?

What's the first step to buying a home?

Can I buy a home while selling my current one?

What conditions are common in New Brunswick offers?

How competitive is the Moncton market right now?